The startup ecosystem in Southeast Asia (SEA) has long been a vibrant hub for innovation and growth. However, recent global economic shifts and the aftermath of the COVID-19 pandemic have ushered in a new era of funding challenges.

In the past, SEA startups enjoyed a robust investment climate characterized by abundant capital and high growth rates. Venture capitalists (VCs) were eager to invest, driven by the prospects of substantial returns. However, the landscape has shifted significantly. The pandemic and subsequent economic headwinds have led to a recalibration, with investors now prioritizing profitability over growth.

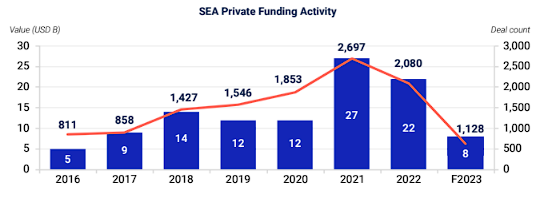

From 2020 to 2023, SEA experienced a notable decline in private funding, reaching its lowest level in six years. This decline mirrors global trends, where increased interest rates and higher capital costs have reduced the availability of cheap capital. Investors have become more cautious, extending the capital-raising process and intensifying competition among startups for limited resources.

Source: YCP White Paper

The most significant change in the startup landscape has been the shift from a growth-centric model to one focused on profitability. Startups are now under pressure to demonstrate sustainable business models. This shift has forced many companies to revise their customer acquisition strategies and optimize their operations to extend their financial runway. For instance, companies like Grab and Lazada have implemented cost-cutting measures and layoffs to weather the financial storm.

Valuations, particularly for growth-stage startups, have also adjusted markedly. Investors are now less willing to fund companies that do not show a clear path to profitability. Consequently, profitable startups are holding off on new funding rounds, while unprofitable ones are seeking capital at significantly lower valuations.

The current environment presents opportunities for new investors to acquire stakes in startups at discounted valuations. This is especially true in the secondary market, where venture capitalists (VCs) looking to exit older investments are selling at substantial discounts. However, new investors must navigate complex cap tables and negotiate differential pricing to secure favorable deals.

Early-stage startups face particular challenges as achieving both high growth and profitability is difficult. VCs and angel investors remain cautious, often demanding higher returns or accepting lower valuations, which increases competition among startups at similar stages of development.

The current trends in the Southeast Asian (SEA) startup ecosystem reflect a broader shift toward sustainability and strategic growth. Startups are increasingly prioritizing long-term sustainability over rapid expansion. This shift includes adopting more efficient spending practices and aiming for steady, healthy growth rather than aggressive market capture.

Additionally, investors are becoming more diligent, thoroughly scrutinizing business plans and financial assumptions. This heightened scrutiny has led to longer due diligence processes and more stringent investment terms, including the implementation of anti-dilution provisions.

Despite the overall funding crunch, certain sectors, particularly those related to digital transformation and e-commerce, continue to attract significant interest. These sectors have strong growth potential even in a challenging economic climate.

There are notable differences within the SEA region, with countries like Singapore and Indonesia continuing to be major hubs for startup activity. These countries benefit from more mature ecosystems and better access to funding compared to other SEA countries, making them attractive locations for both startups and investors.

Source: https://ycpsolidiance.com/white-paper/southeast-asia-startups-challenges-2024

Leading the Charge: Major Players in SEA’s Digital Lending Market

The fintech lending market in SEA is poised for substantial growth, including digital lending which is set to surpass digital payments as the primary revenue driver for the region's digital financial services sector by 2025, with a compound annual growth rate (CAGR) of 33%. This growth is fueled by the widespread adoption of automated loan origination processes and the seamless integration of financial services into digital platforms.

Unlocking Opportunities in the SEA Digital Financial Services Landscape

In recent years, Southeast Asia (SEA) has emerged as a hotbed for fintech innovation, transforming the financial landscape across its diverse markets. This transformation is characterized by a surge in digital financial services (DFS), revolutionizing how individuals and businesses manage their finances. However, the journey is not without its challenges, and understanding these is crucial for stakeholders aiming to navigate this rapidly evolving sector.

Challenges for Sustainable Recovery in Southeast Asia

Sustainable recovery in Southeast Asia faces numerous challenges, yet also presents significant opportunities for green growth. Addressing sustainable issues is crucial for achieving a resilient and sustainable future.

Driving Cross-Border Growth: Regional Logistics Initiatives in Southeast Asia

The logistics landscape in Southeast Asia (SEA) has undergone significant improvements. The SEA logistics market was valued at over USD 497 billion in 2020 and is projected to expand further in the coming years. The SEA logistics market is driven by various regional initiatives and government policies to enhance connectivity, efficiency, and competitiveness across the ASEAN. These initiatives have facilitated smoother cross-border trade and stimulated investment and innovation within the logistics industry.